The following is an excerpt from a risk report relating to the intended acquisition by Pierre Michel Louvrier of key Bulgarian’s strategic telecommunications and defense industry assets.

Risk Event

Pierre Michel Louvrier, (PML), a Belgian citizen, seeks to acquire controlling stake in a group of strategic companies in Bulgaria, including the former telecoms monopoly BTC, the largest-penetration mobile operator Vivacom, the monopoly on TV and radio distribution NURTS, the monopoly on terrestrial TV distribution First Digital, the market-leading TV audience measurement service GARB, a munitions manufacturer company (Dunarit), and a service company for Russian military helicopters/fighter jets Avianams (“Bulgarian Entities”).

The group of companies is being acquired via a newly set-up Luxembourg SPV, LIC33 Sarl, where PML appears as the sole proprietor of capital.

The sellers are a group of SPV’s and offshore entities effectively controlled by fugitive banker Tzvetan Vassilev, currently in exile in Serbia and fighting extradition proceedings initiated by Bulgaria.[1]

The purchase price for the Bulgarian Assets, as disclosed by PML at the press conference in Sofia on March 24, 2015, is €1. To justify the notional price, PML referred to the assumption of liabilities of €900 m (which, in fact, are liabilities of the Bulgarian Assets, not of buyer).

Identity and history of buyer

As the buyer of the Acquiring Entities is a new SVP and the purchase price is notional, the actual transaction and identity of the acquirer requires an analysis of the nominal buyer’s prior transactional history.

PML, born December 2, 1973, is a Belgian national, having worked primarily as investment banker and based in Russia over the last 10 years.

Since 2010, he has operated primarily as CEO of “CFG Capital Ltd”, a black-box investment vehicle with (publicly) unidentified shareholders. CFG has marketed itself as a private equity fund seeking to invest in FMCG, agricultural and IT businesses in Russia and the CIS. CFG’s most visible investment to date has been in RusFrain Holding, a leading Russian agricultural manufacturer and trader. PML is a non-executive member of the Supervisory Council of RusGrain Holding.

CFG Capital’s Joint Venture with Market Capital

On November 13, 2014, a press release on Market Capital’s (MarCap) website announced the forming of a joint venture between MarCap and CFG Capital, for investments in Russia:

Marshall and CFG Capital announce partnership for investments in Russia

“Marshall and CFG Capital investment funds announce today a partnership which will result in the establishment of a new venture named CFG Marshall with a total volume of investments of more than 2 bln euro”

The press statement announced that the new JV will have Konstantin Malofeev and PML as co-investors and co-managers, and will have prominent French and Russian public figures on its Advisory Board. Furthermore, the press release quoted PML as saying:

Pierre Louvrier, Chairman of CFG Capital: «Macroeconomic situation in Russia presents great opportunities for investments. Value of assets in Russia will grow, allowing for profitable long-term investments. I believe that the synergies generated as a result of this partnership of two high-profile investment teams will bring to both companies new ideas, new ways to make business, resulting in higher efficiency for both. We hope to announce launch of new projects on the Russian market in the nearest future. These synergies will also give me personal time to dedicate to CFG’s social responsibility projects in favor of Russian leadership in Europe».

Further, Konstantin Malofeev was quoted as follows:

«CFG Marshall will gather the best of both CFG capital and Marshall. CFG Capital is a professional investor with unique expertise of executing projects on both Russian and European markets. I am pleased to find in its capacity a reliable partner which I can fully entrust with financial management of the assets. This cooperation will allow me to concentrate efforts on projects which require my direct involvement – development of Saint Basil the Great Charitable Foundation and Gymnasium, construction of thematic parks of Russian history “Tsargrad” in Moscow region and Crimea, and other social projects».

In the press statement[2], MarCap is described as having a key investment focus in telecommunications, media and technology, as well as real estate and agriculture”. CFG Capital in turn is described as “maintaining a zero communications policy and does not provide public comments on its operations”

In summary, the language of the MarCap announcement indicates that Konstantin Malofeev planned effectively to delegate investment decisions and financial management of the MarCap investment fund to CFG Capital, which is controlled and managed by PML.

Following the announcement of the creation of the JV, Malofeev was interviewed by a Russian business newspaper Vedomosti, where he confirmed that he will outsource his investment decisions to CFG’s management in exchange for “commission on the profit”. Malofeev also described his belief that “the European origin of his partner will not mean that the joint investments will be subjected to European sanctions”

Malfoeev also announces that the Advisory Board will include in addition to himself, the first deputy speaker of the Russian Senate Alexandre Torchin (also on the EU sanctions list), as well as Thierry Mariani, an MP in the French Parliament and a former deputy state secretary for transport in the French government.

French journalists and bloggers discover the planned affiliation, via CFG Capital, between MP Mariani and Malofeev – who has been on the EU and US sanction list since August 2014. The scandal causes Mariani to disclaim his link to the JV project, insisting that his name was added to the Advisory Committee by Pierre Louvrier without his consent.

Following the negative publicity in French media, CFG Capital deleted the names of Mariani and Torchin (as advisory committee members) from its website and added, instead, a Ukrainian citizen, Anatoly Kairo.[3] In a subsequent statement on the CFG website[4], the company denying that it was under any JV agreement with “politically exposed persons”, without mentioning Malofeev specifically. The statement attacks Vedomosti for publishing “untrue information” about the JV plans. At the same time, the statement makes no reference to the detailed information about the JV, including quotes from PML himself, still present on MarCap’s website. The statement also mentions CFG’s plans to suspend investments in Russia due to the unattractive economic climate.

The website aihitdata.com, which specializes in tracking changes in corporate websites, confirms the exact dates and names of the changes made to the CFG Capital website.

PML and the Russian-Ukraine Conflict

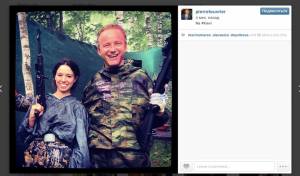

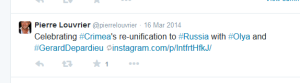

Since the beginning of the Russian-Ukrainian conflict, PML has consistently pursued – in social media statements – an anti-Ukraine and anti-West rhetoric. Appendix 1 presents certain of the comments made by him on Twitter, including a statement from March 16th 2014 celebrating the Russian annexation of Crimea.

In his Instagram profile, PML has published provocative anti-Ukraine photos, such as a Photoshop montage of himself with an AK47 with the heading “Onward to Kiev”. He has also published photos of himself next to Igor Girkin (Strelkov), praising him as “a modern Russian hero”. Girkin is the EU-sanctioned Russian military commander who oversaw the initial invasion by Russia, first in Crimea and then (as Supreme Commander of the so-called DNR) in Eastern Ukraine. Girkin’s initial assignment to Ukraine (in January-February 2014) was during his employment as Chief of Security for MarCap. Furthermore, intercepted phone conversations from March 2014 provide evidence that during the take-over of Slovyasnk, Girkin was (still) reporting directly to Konstantin Malofeev.[5]

Analysis

PML’s denial and destruction of evidence of his involvement with Konstantin Malofeev and Alexandr Torshin clearly indicates that he has been untruthful, both in his statements on the CFG Capital website, and during the press-conference in Sofia, where he denied ever having links with Malfoeev. Furthermore, at the press conference he stated that he has had no political linkage in Russia; both the presence of the deputy chairman of the Russian Senate on his fund’s investment committee and his photograph with, and eulogy of, Igor Girkin (who, in addition to being wanted by Ukraine on terrorist charges, is the chairman of a new political movement in Russia) suggest the exact opposite.

The analysis of PML’s transactional history and behavior in the last year makes it highly probable that in his current acquisition of the Bulgarian Assets, he acts as a proxy for a third party. At least one case of acting as proxy-owner (for Alfa Holdings) has been confirmed with documents; and his involvement with the CFG Marshal joint venture bears all the marks of a plan to avoid the impact of EU sanctions by outsourcing (part of) MarCap’s investment activity to PML.

Within this general assumption, there are two hypothesis. Either

(A) PML acts as proxy for the seller Vassilev, an indicted banker whose assets are threatened to be impounded as part of the criminal investigation against him.[6] Thus, in this hypothesis, the seller tries to create an optical separation between himself and his key remaining assets, aiming to preserve them via a fictional “sale” to a third party. The purchase price of €1 is consistent with this hypothesis.

(B) PML acts as a proxy of Konstantin Malofeev, and possibly other related Russian investors. This hypothesis is supported by the following:

- The announced JV for “outsourced” investment activity only 4 months before the Bulgarian transaction. Furthermore, Malofeev’s own statements in relation to the planed JV (CFC-MarCap) strongly indicate plans to outsource not only capital management, but possibly also capital nominee ownership. The JV was hastily refuted by PML after the French public scandal, and also at the press-conference in Sofia, but there are clear documentary traces proving that the joint venture was in fact agreed and planned.

- The overlap between the strategic interests of Malofeev and the Bulgarian assets. Malofeev has been an investor in Russian telecoms companies (Rustelecom, Svyazinvest, SMART mobile operator), and states telecommunications as his investment focus.

- The simultaneous appearance of another Malofeev-linked “foreign investor”, the US citizen Jack Hanick, as a potential purchaser or another asset owned by Vassilev – the national-coverage TV station TV7. Hanick was the founding CEO of Maloeev’s own TV station in Russia, Tzargrad TV, and is a close confidant of Malofeev’s.

- The unusual behavior by PML during his press-conference. While initially refusing to comment on his linkage to Malofeev, due to the persistent questioning by journalists, he provided an improbable explanation to the public records of links, i.e. that Malofeev wanted to be his partner and presented it as reality, but that PML “could not be a partner with a sanctioned person” (contradicting the fact that another sanctioned person is on his company’s Advisory Committee). At the same time, he never used the name Malofeev in his rebuttal, suggesting he feared being put on the record in case of future leakage of proof of his links.

- The fact that one month before the acquisition, Malofeev and VTB Capital, the other large investor in BTC, settled their 7-year-old legal dispute, with Malofeev paying an inexplicably discounted price to VTB for settling his debt.[7] It is likely that the discount will be cross-accounted in the partner relationship within BTC[8]

The most probable hypothesis is a combination of A and B, i.e. Malofeev is the principle investor behind PML, but Vassilev may retain a residual economic interest. It is also possible that Malofeev is providing additional political assistance to Vassilev due to his contacts with influential politicians in Serbia[9]

Key Risks to Bulgaria

In the most probable hypothesis, the risks from (beneficial) ownership of the Bulgarian Assets by Malofev are severe.

On the one hand, Malofeev has financed and facilitated the invasion of Ukraine by Russian paramilitary and military forces, which has resulted in his placement on the sanctions list. This alone is sufficient to make unacceptable his ownership of the leading telecoms infrastructure in the country with access to government and private data essential to national and European security. The same holds true about his potential control over the monopoly over TV distribution in an EU country.

Secondly, Malofeev’s prior control over telecoms assets has resulted in attempts to abuse them for political purposes, even in Russia. While he was in control of Rostelecom, the company had a monopoly over local e-government in the federal districts in Russia. In a letter to Putin, a group of governors complained in early 2012 that Malofeev has abused Rostelecom’s position to exert political pressure over them, using the threat of raising prices for critical e-government infrastructures. If Malofeev had the ambition to use his telecoms asset to interfere with political life in Russia, such ambition may be even more easily implemented in Bulgaria (see Appendix 2). Along the same line, Malofeev has used his position as chairman of the Russian Internet Safety League to block access to certain sites in Russia that have been disclosing compromising data on him.

Third, Malofeev has been the center of several criminal investigations. These include fraud accusations by Western investors, accusations over take-over raids by competitors, electoral bribing, and the already mentioned fraud case in relation to VTB. (Evidence available upon request)

NB! All of the above-listed actions by Malofeev constitute criminal offences under Russian law. Formal charges have not been raised on any of them; however the possibility of such make Malofeev an investor who is controllable by the Russian government.

All of these facts taken together make it an urgent necessity for Bulgaria to block the possibility of a potential transfer of control of the Bulgarian Assets to Malofeev.

Options available to the Bulgarian government

The following legal options exist for Bulgaria’s government to block the pending transaciton with the Bulgarian Assets:

[REDACTED FOR CONFIDENTIALITY]

[1] Vassilev was indicted in 2014 on charges of large-scale embezzlement from the now-bankrupt CorpBank, the bank has been lender to (or financer of the original acquisition of) most of the Bulgarian Entities

[2] http://www.marcap.ru/en/press/news/item/64

[3] At the Sofia press-conference, Anatoly Kairo was presented by PML as one of the management team of LIC33

[5] https://www.youtube.com/watch?v=nSYSU7j0HNA

[6] The prosecution accuses Vassilev of creating a Ponzi-scheme of related party-borrowing, totaling, by the prosecution’s accounts, nearly €2 b.

[7] In 2007, Malofeev, acting under false pretense, borrowed USD 232 m from VTB Capital, and never returned it due to the borrower company going bankrupt. Despite winning the court proceedings for the full amount including interest, VTB Capital settled, in February 2015, for $100 m.

[8] PML has announced that LIC33 intends to buy out the remaining shareholders in BTC; VTB owes nearly 40% of the shares.

[9] In recently leaked email correspondence between Malofeev and one of his employees, he refers to the current governing party in Serbia as “Our Serbs” and implies influence over them. Unconfirmed information from two sources suggests Malofeev may be assisting Vassilev in obtaining Russian citizenship to avoid extradition to Bulgaria.

One thought on “Malofeev’s JV Partner Acquring Strategic Bulgarian Assets: A Risk Analysis”